[ad_1]

Analyst firms S&P World wide Market place Intelligence and Gartner have the two supplied adverse evaluations of Broadcom’s takeover of VMware.

S&P surveyed VMware consumers and located 44 percent feel neutral about the offer, and 40 % expressed destructive sentiments.

But when the analyst crunched the figures for present-day prospects of each VMware and Broadcom, 56 per cent expressed destructive sentiments. More than a quarter rated their reaction to the deal as “really adverse”.

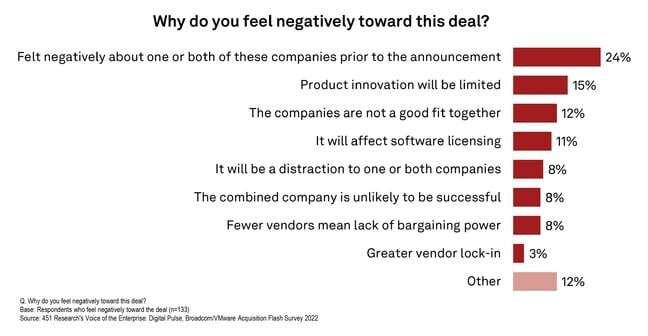

1 explanation S&P cited for that reaction was “likely impact on computer software licensing terms and ailments. Here’s the analyst’s record of other issues elevated by customers:

Analyst team Gartner’s views on the deal concentration on possible price rises, and how best to stay clear of them.

In a doc titled “Swift Respond to: How Need to VMware Clients Get ready for the Broadcom Acquisition?” Gartner’s analysts compose: “Following Broadcom’s acquisitions of CA Technologies and Symantec, numerous consumers complained to Gartner about dramatic out-the-doorway value increases in the course of renewals, with minimal adaptability for negotiations.”

The analyst group also sees “an influx of midsize and smaller sized buyers wanting to migrate away thanks to amazing price boosts and worries with support.”

Gartner thus implies VMware prospects need to lock in extensive-expression pricing with VMware prior to the Broadcom offer concludes.

“Regulate negotiating procedures and mandate that VMware dedicate to certain provisions in producing prior to creating massive or strategic financial investments,” the doc advises, noting that it will be a lot of months in advance of the acquisition is total.

“Negotiate exit clauses in new multiyear contracts,” the doc provides. “Negotiate price tag caps on membership VMware license charges. Cost caps should really be in just one particular % to two percent of a normal metric these types of as the buyer rate index.”

Other assistance phone calls for clients to secure commitments for shipping and delivery of technological enhancements for VMware solutions, in particular code other than vSphere, NSX and vSAN.

And just in circumstance Broadcom makes lifestyle intolerably miserable, Gartner recommends VMware users “Detect exit ramps for deployed solutions, which include alternate answers and migration activities.”

Gartner also sees some upside in the acquisition, specifically the probability of:

- Enhanced co-engineering with Broadcom’s existing portfolio, major to product or service integration enhancements. Some possible illustrations consist of VMware Venture Monterey with Broadcom’s semiconductor business enterprise, Broadcom’s ValueOps with Tanzu and a sturdy solitary-vendor SASE supplying

- Expected strong ongoing investment decision in the VSAN, NSX and vSphere products and solutions, as Broadcom seeks a emphasis on hybrid clouds

- Improved breadth of technological means of the combined entities to compete extra proficiently with AWS, Microsoft, Google and IBM/Purple Hat.

S&P’s investigate incorporates 1 user’s view that Broadcom could be the excellent operator for VMware, mainly because if other organization computing giants obtained the virtualization leader it would be challenging to retain the “Switzerland of cloud” status VMware covets.

A further Gartner prediction is that Broadcom could rationalize some products and solutions, as the artist previously identified as Symantec and VMware’s Carbon Black unit equally present endpoint safety products and solutions, while CA sells and visibility and automation tools.

Gartner’s information nods to Broadcom’s general public statements that it focuses its focus on pretty big consumers and trims R&D shell out aimed at more compact people, and options a immediate shift away from perpetual licenses for VMware products and solutions. Broadcom has also stated that it expects VMware to generate pretty much $4 billion much more annual revenue by 2025 – substantially more rapidly development than the virtualization large has accomplished in modern several years.

Broadcom execs have stated the corporation options to carry on expense in core VMware goods, and that it sees VMware’s lover group as featuring possibilities and prospects it cannot at this time address.

S&P’s investigation also indicates Broadcom’s remarks about the VMware channel sign the chip structure business would not implement the exact same strategies it utilised right after shopping for CA and Symantec.

But Broadcom’s past selling price hikes and indifference to smaller sized consumers are presently the most obvious evidence of its solution acquisitions, leaving VMware customers The Register encountered nervous about the impact of the acquisition. ®

[ad_2]

Resource hyperlink

More Stories

‘Gold Hydrogen’ Is an Untapped Resource in Depleted Oil Wells

An All-Inclusive Guide for Prospective Gold Investors in Brisbane

Unraveling the Complexities of Car Insurance