[ad_1]

As anyone who knows me will notify you, I’m not considerably of a “chart man.” I ordinarily shell out significantly extra interest to the fundamentals and the macros of an financial commitment (somewhat than its complex). In lengthy run, the fundamentals and macros will eventually establish the trajectory of a inventory.

On the other hand, I do understand the worth of complex examination. And previous week, I compiled a chart depicting a certain group of tech shares is primed for a big breakout!

As it turns out, this chart arrives to the specific exact same conclusion that my basic and macro investigation did. And of study course, I’m bullish.

Let’s get to the chart in query.

The Most Powerful Chart for Hypergrowth Tech Shares

More than the previous yr, hypergrowth tech shares have struggled in a sizeable way. Effectively, they rallied massive by the complete 2010s. Investors grappled with inflation fears in 2021 for the first time in a long time.

But over the past couple of months, those people overwhelmed-up hypergrowth tech shares have staged a extraordinary comeback. The likes of it could be a enormous turning point for the sector.

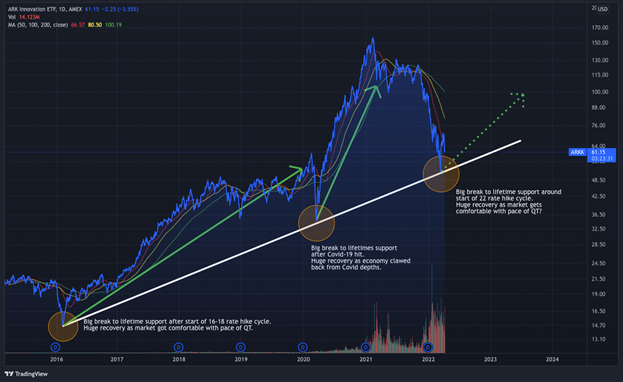

Just glimpse at the following chart, which graphs Cathie Wood’s ARK Innovation trade-traded fund (NYSEARCA:ARKK). That portfolio of about 36 distinctive tech shares serves as a good proxy for the hypergrowth tech sector.

Around the past couple weeks, the ARK ETF bounced off a life time guidance level for the fund.

It to start with hit this assist degree in early 2016, following the Fed entered its initial price-hike cycle due to the fact 2008. The ETF proceeded to rebound strongly and rallied in a sizeable way over the upcoming four many years.

Then, all through the Covid-19 market meltdown of March 2020, the ARK ETF hit this lifetime help amount after more. Nonetheless all over again, it rapidly rebounded off it and rallied in a substantial way around the future calendar year.

Nowadays we discover ourselves in a identical predicament. The ARK ETF has crashed to its lifetime assist stage. And it has immediately, drastically and quickly rebounded once again.

History reveals that what comes next is a big rally in hypergrowth tech shares. If not, then a multi-yr development relationship back to 2016 will crack — which we perspective as very unlikely.

This chart is just one particular knowledge place in a sea of investigation. And it all supports the idea that hypergrowth tech stocks are due for a massive melt-up in 2022.

Plenty of Purchase Indicators Are Flashing for Tech Stocks

In fact, we have three other critical information details that strongly guidance the hypergrowth tech inventory bull thesis at current.

The very first is the yield curve. It has inverted four moments more than the earlier 35 yrs — in 1988, 1998, 2008 and 2019. Each time, tech stocks struggled into the curve’s inversion. Just after it, all those same struggling shares soared. Returns in tech stocks more than the 12 months next a produce curve inversion have traditionally averaged about 30%. And they’ve hardly ever been detrimental.

So, produce curve inversions are likely to spark tech inventory soften-ups over the subsequent 12 months. We do not think this time will play out any in a different way.

The 2nd is the most latest amount-hike cycle. The past time the Fed hiked prices was between December 2015 and December 2018. Into that cycle — and immediately next the very first hike — tech stocks struggled. Shortly soon after the to start with boost, however, the sector turned comfortable with the thought of quantitative tightening. And crushed-up tech shares rebounded with vigor.

It appears to be like like background is repeating by itself these days. Tech shares have struggled into this rate-hike cycle. But ever since it commenced, they’ve been breaking out. It seems to be like we’re in the early phases of a repeat of 2017 — wherein the ARK fund in essence doubled.

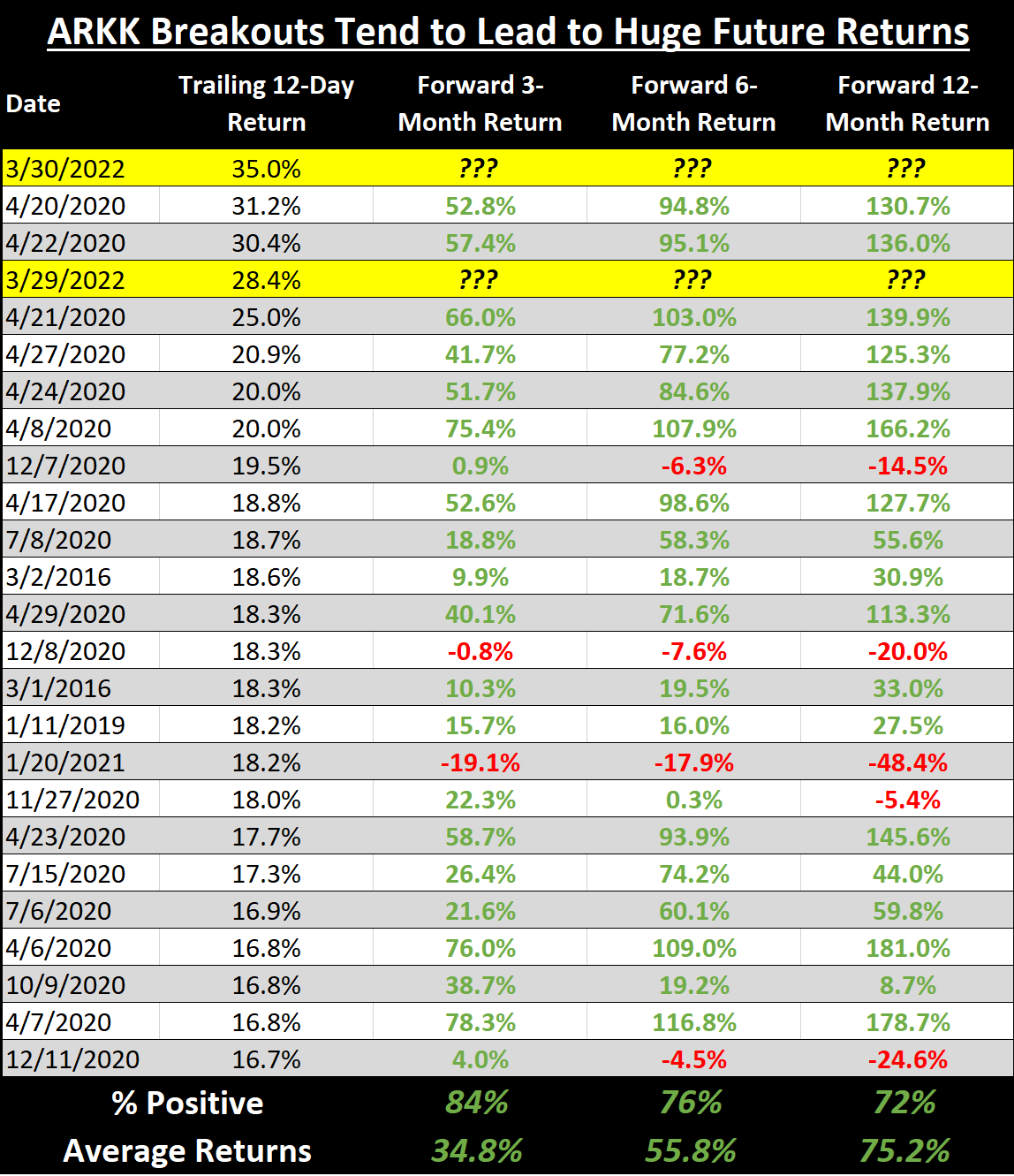

The 3rd is the latest ARK breakout. The ARK fund is amid its largest breakout at any time. Past pops like this took place in March 2016, January 2019, April 2020 and July 2020. Every a person of people breakouts led to substantial a few-, six- and 12-month forward returns in hypergrowth tech shares.

The only time the ARK Innovation ETF did not see huge returns next a jump like we’re seeing currently was in December 2020. And that breakout was a soften-up on the heels of large rally. That’s the correct opposite situation we have nowadays (a breakout on the heels of a significant downtrend).

Total, even such as the December 2020 “head faux,” huge limited-expression breakouts in hypergrowth tech stocks like we’re seeing nowadays are likely to generate, on average, 35% returns more than the future a few months, 56% returns more than the following six months, and 75% returns in excess of the upcoming 12 months.

Individuals, when strung with each other, this info is difficult to argue from.

There is historical precedent for a submit-yield-curve inversion tech market place melt-up. There is historical precedent for progress shares outperforming in level-hike cycles. And there is historic precedent for massive breakouts in tech stocks, making even even larger returns more than the subsequent months. And we have a hypergrowth tech inventory chart that screams “huge rebound incoming!”

We’re sold. We feel the following 12 months will generate some huge returns in crushed-up hypergrowth tech shares. And we’re ready to capitalize on individuals gains in our flagship investment decision research advisory Innovation Investor.

The Last Phrase

My group and I satisfaction ourselves in employing a knowledge-driven investment decision method.

That is, we do not arrive up with a method primarily based on intuition and then appear for data to aid it.

We carry out advanced and comprehensive info evaluation, and then allow that assessment tutorial our expense method.

Appropriate now, our info analysis is telling us to get tremendous bullish on washed-out hypergrowth tech shares.

So, that is what we’re doing. We’re backing up the truck and loading up on shares of shares that we imagine can double in a hurry. And they could rally countless numbers of % in the long run.

Just one these kinds of stock represents arguably the most promising tech startup in the entire world these days.

It is a biotech organization started by a bunch of MIT alumni. And it is acquiring floor-breaking technological know-how that could allow us to reshape the globe as we know it.

The company’s stock price? Considerably less than $5. That indicates now, you have a unique option to get in on the ground-flooring of what my staff and I feel could be the rising “Microsoft of Biology.”

And I’ll tell you anything you require to know about this tiny company and the innovative technological innovation it is doing the job on appropriate now.

On the day of publication, Luke Lango did not have (either specifically or indirectly) any positions in the securities pointed out in this report.

[ad_2]

Resource link

More Stories

Don’t Use an Apple AirTag as a Pet Tracker – Use a Whistle Instead!

A growing number of Samsung owners are using the same terrible password

Amazon begins layoffs of up to 10,000 jobs, blames “uncertain” economy