[ad_1]

This short article originally appeared on Simply just Wall St News.

Previous 7 days Micron Engineering ( NASDAQ:MU ) released second quarter effects. The benefits were comfortably ahead of forecasts, and steering for the third quarter was lifted. Immediately after in the beginning attaining 4.7%, the share cost tracked the sector reduced.

Micron has very low anticipations priced into its existing valuation. At the similar time, info middle desire appears to be much better than expected , and if that proceeds expectations could improve meaningfully.

Next quarter final results at a glance:

-

EPS: $2.14, up 118% 12 months on calendar year and 16 cents forward of consensus estimates.

-

GAAP EPS: $2.00, up 277% calendar year on yr and 16 cents forward of consensus estimates.

-

Profits: $7.78 bln, up 24.8% yr on yr and $244 mln improved than predicted.

-

Desire and charges for NAND and DRAM memory chips go on to increase.

-

Facts heart demand from customers for memory and storage is expected to outpace broader marketplaces above next ten years.

-

3rd quarter advice: Profits estimate lifted from $8.1 bln to ~$8.7 bln and EPS from $2.21 to ~$2.33.

Micron’s in close proximity to-phrase outlook has enhanced, despite the fact that it is really unlikely to match the very last quarter’s earnings development. But what definitely matters for investors is the expectations that are at this time priced into the stock and how they might adjust more than time.

How does Micron Evaluate up in opposition to the Tech Sector and Semiconductor Business?

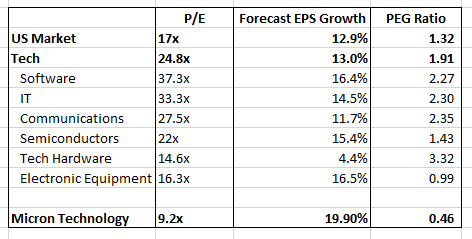

If you appear at the Simply Wall St Marketplaces page , you can see the price-to-earnings ratio and forecast earnings progress prices for every single sector, and for each and every field within just each individual sector.

We can see that the normal P/E ratio for semiconductor shares is 22x, which is the third most affordable amongst the six industries, and considerably decrease than the software industry which is at 37.3x.

When we search at forecast advancement rates, the semiconductor sector is envisioned to grow at 15.4%, which is only marginally lessen than the computer software and digital machines industries.

We can also merge the P/E ratio and development forecast by calculating a ‘PEG’ (P/E to Advancement) ratio. By dividing the P/E ratio by the envisioned advancement amount we get there at values that are much easier to compare . We can add Micron to the list two to see how it compares to the industry, the tech sector, and the semiconductor marketplace.

The latest PEG ratios recommend that the semiconductor field is much more favorably valued relative to expansion expectations than all the tech industries apart from digital tools. This does not imply semiconductor stocks will execute improved, but that expectations relative to forecasts are currently reduce.

Micron Technology’s P/E and PEG advise anticipations are even decreased. The existing forecast EPS development charge for the up coming number of years is 19.9%. When EPS increased by 182% in excess of the very last 12 months, analysts are expecting a sharp slowdown in the future number of many years.

Demand and selling prices for memory and storage chips is cyclical, so revenues are normally lumpy. In truth it’s hard to forecast desire far more than a calendar year or two forward, so analyst estimates are understandably conservative – and their forecasts are probable to alter. The great information for traders is that these forecasts are small, and the present P/E is small relative to those people forecasts.

What does this indicate for buyers?

The bottom line listed here is that Micron is presently viewing potent desire for its products and solutions, although the market’s expectations for the potential are very low. This contrasts with a great deal of other technological know-how stocks that have optimistic forecasts and even extra optimistic valuations. This indicates downside for Micron could be minimal, whilst there is prospective for significant upside if the extended-term outlook improves.

To discover a lot more about the organization, have a search at our hottest examination for Micron Engineering . You can use the Simply Wall St Screener to obtain other semiconductor shares with solid fundamentals.

Have comments on this posting? Worried about the information? Get in touch with us straight. Alternatively, e mail [email protected]

Simply Wall St analyst Richard Bowman and Simply just Wall St have no placement in any of the businesses pointed out. This post is normal in nature. We give commentary based on historic facts and analyst forecasts only employing an unbiased methodology and our posts are not supposed to be monetary suggestions. It does not constitute a advice to invest in or provide any inventory and does not choose account of your objectives, or your economical circumstance. We intention to carry you extended-term focused evaluation driven by fundamental facts. Be aware that our examination could not issue in the latest cost-sensitive business bulletins or qualitative material.

[ad_2]

Source connection

More Stories

Apple Black Friday Sales, iPhone 15 Pro rumors, Device Buying Guide

How Businesses Can Overcome Cybersecurity Challenges

Sam Bankman-Fried could face decades in jail if convicted of law violations in FTX collapse, lawyers say