[ad_1]

porcorex/iStock through Getty Images

Superior-produce investing has admittedly develop into rather simple in new weeks, with even some blue-chip names these as Altria (MO) throwing off a around 9% generate. It is really uncomplicated to come to be jaded, having said that, as one particular might accept that this is the new norm, particularly looking at the present inflationary natural environment.

If background is of any indicator, even so, it can be that large dividends could not previous endlessly, and that now may be a good time to get more of one’s preferred shares while also diversifying into other money sources.

This delivers me to Horizon Technological innovation Finance (NASDAQ:HRZN), which now yields 10.4%, after acquiring fallen from the $16 amount just earlier this 12 months to just $11.55 at existing. In this post, I spotlight what can make HRZN a possibly excellent earnings portfolio diversifier, so let’s get begun.

Why HRZN?

Horizon Technological know-how Finance is an externally-managed BDC that offers secured financial loans to venture cash and non-public equity backed growth businesses in the technology, daily life science, and health care info and products and services industries.

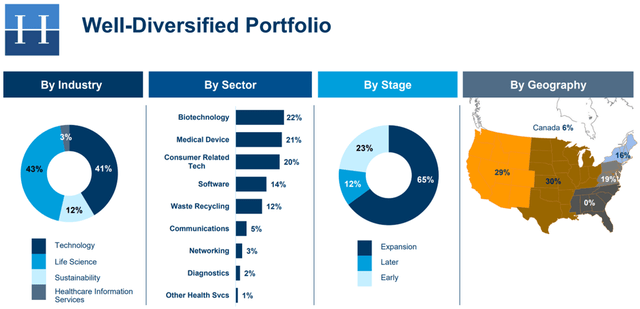

HRZN’s portfolio is properly-balanced by marketplace, with 41% of portfolio reasonable price allocated to technology, 43% to lifestyle science, 12% to sustainability, and the remaining 3% to healthcare data systems. As proven beneath, most of HRZN’s portfolio is allotted to businesses in the a lot less dangerous expansion and later on stages, signaling maturity and additional line of sight.

HRZN Portfolio Blend (Trader Presentation)

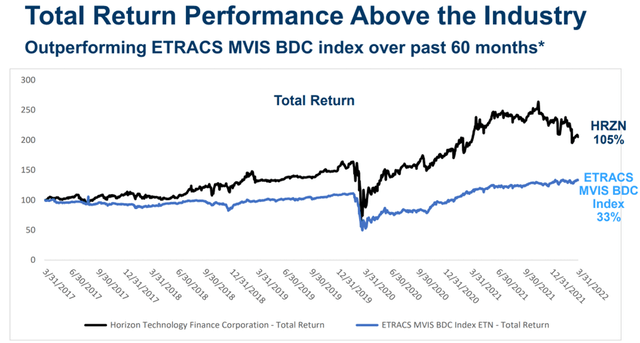

This technique has served HRZN properly, as demonstrated by its solid complete returns in excess of the past 5 many years, with a 105% full return from 3/31/2017 to 3/31/2022, beating the 33% full return of the ETRACS BDC Index, as revealed under.

HRZN Full Return (Trader Presentation)

In the meantime, HRZN is observing reliable fundamental fundamentals, with a large 14.9% common personal debt portfolio produce over the trailing 12 months, despite the fact that this has cooled a bit to a however robust 12.4% through the initial quarter. HRZN is also observing spectacular portfolio expansion of 36% in excess of the past 12 months, to $515 million.

Additionally, HRZN maintains a small risk profile, looking at that its borrowers have on normal a lower 20% bank loan to benefit ratio, evaluating favorably to the 80% LTV ordinary for mid-market place loans.

This reduced-possibility tactic is reflected by the reality that HRZN has just one particular expense, MacuLogix, on non-accrual, with administration expecting for it to take care of itself above the recent and future quarter though injecting a modest sum of liquidity to make it happen. As well as, administration estimates that practically 96% of the portfolio carries a harmless 3-ranking or much better.

Notably, HRZN is at the moment beneath-earning its $.30 quarterly dividend amount (paid out regular) with $.26 NII for each share in the course of the very first quarter, possessing to do with seasonably mild prepayments. On the other hand, HRZN has a good deal of cushioning to go over its dividend fee, with $.47 for every share of undistributed spillover revenue from prior portfolio liquidity occasions.

It also has a significant addressable market place and a lot of firepower to fund its pipeline, with a reduced .9x debt to equity ratio, sitting properly below the 2.0x statutory restrict. This was reflected by administration in the course of the the latest meeting phone:

Our advisor continues to increase the Horizon platform with supplemental hires and endorsing users of its workforce into essential management positions, making sure we stay on system to make long term development and continued profitability.

The gains of the Horizon platform involve: an expanded lending platform and the electricity of the Horizon model to accessibility a greater quantity of expenditure alternatives, a pipeline of investments that has hardly ever been more substantial, increased ability to execute on a backlog of commitments and new options and an knowledgeable that is cycle-analyzed and completely geared up to take care of as a result of potential macro or financial headwinds.

In close proximity to-phrase threats to HRZN include things like the downturn in growth, namely tech, shares due to the fact the commence of the yr, and this might have a adverse impact on HRZN’s portfolio worth. On the other hand, this may well be momentary, and delayed liquidity situations these kinds of as an IPO or buyout may possibly end result in heightened desire for HRZN’s financial loans, as portfolio corporations may perhaps want to steer clear of dilutive equity sales to venture funds and private equity corporations.

And lastly, the new share rate weakness has manufactured HRZN far more interesting. It now carries a cost to guide benefit of .99x, sitting down properly underneath its variety around the past 3 decades, outside the house the early pandemic time period. Sell side analysts have an common cost focus on of $14.13, implying a opportunity one particular-yr 33% whole return like dividends.

HRZN Cost to Book (In search of Alpha)

Investor Takeaway

Horizon Technologies Finance is a smaller but escalating BDC that has witnessed outstanding full returns over the earlier 5 many years, prior to the latest downturn. It is benefiting from robust underlying fundamentals, with good portfolio development and produce. With the latest share value weakness, HRZN seems to be an desirable get for substantial earnings traders in search of regular dividends and cash appreciation potential.

[ad_2]

Resource hyperlink

More Stories

Education Technology Integration – Computer Microscopes Are Enhancing the Science Classroom

History: Computers Components and Technology

Considerations for Selling Used Computers