[ad_1]

BlackJack3D/E+ via Getty Images

“Only when the tide goes out do you find who’s been swimming naked.” – Warren Buffett

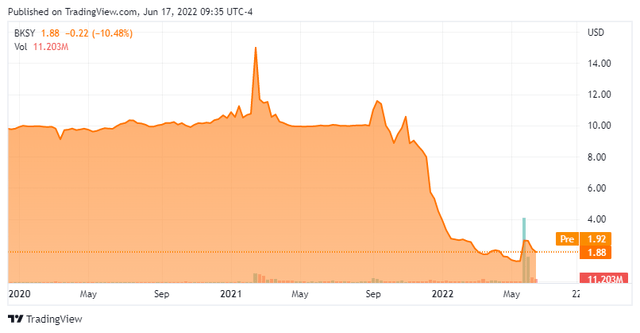

Right now, we acquire our initially in-depth glance at modest-cap problem BlackSky Engineering Inc. (NYSE:BKSY). BlackSky arrived public late past summer via a merger with Osprey Technological innovation Acquisition. Like so quite a few of these SPAC debuts in 2021, the shares find them selves deep in ‘Busted IPO’ territory. The company is providing spectacular profits progress in its rapid-expanding market of the market place, nonetheless. An assessment follows underneath.

Seeking Alpha

Corporation Overview:

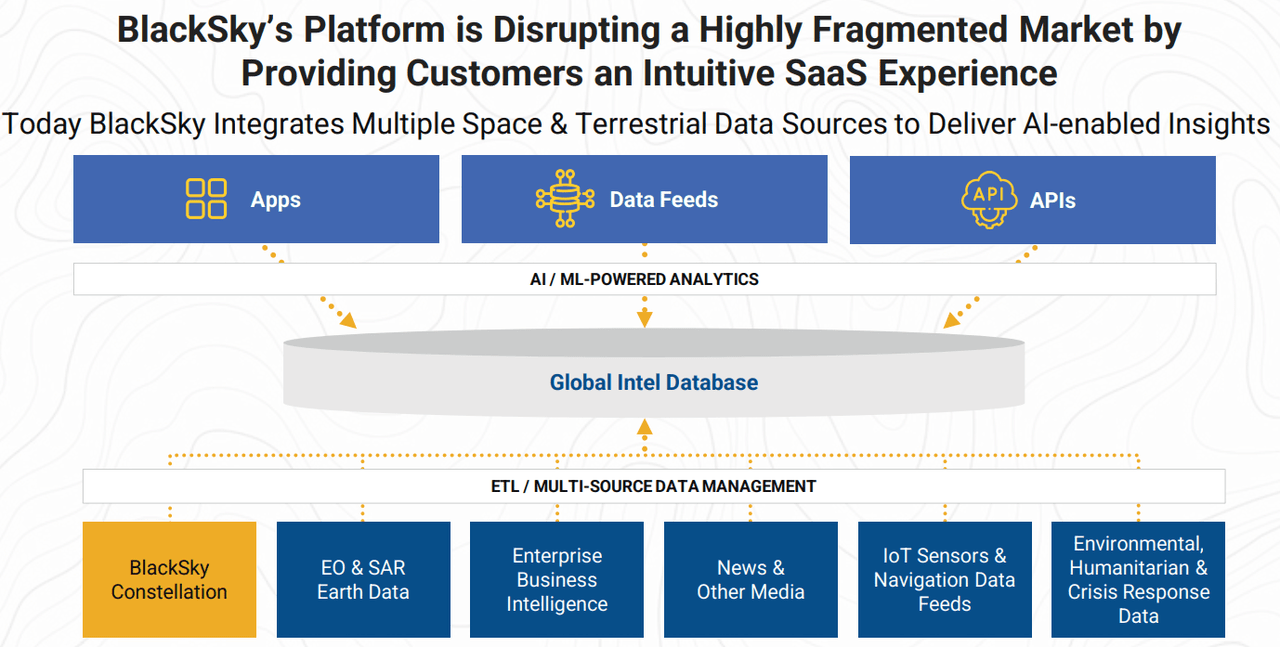

BlackSky Technological know-how Inc. is dependent just exterior of Washington D.C. The inventory trades for just beneath two bucks a share and athletics an approximate market place capitalization of $240 million. BlackSky gives geospatial intelligence, imagery and relevant details analytic solutions and companies, and mission programs. These consist of the enhancement, integration, and operations of satellite and ground units to industrial and government purchaser purposes. The company provides these insights and data by way of its Spectra AI SaaS platform which is run by their proprietary space and terrestrial sensor community.

BlackSky’s on-desire constellation of satellites (a full of 14 proper now soon after launching two satellites on April 2nd) can image a place many situations all over the day. Palantir Systems (PLTR) has an equity investment decision in BlackSky. BlackSky also has a multi-calendar year application membership deal with Palantir to entry the Palantir Foundry business platform, and the corporation presents a option that combines Palantir Foundry with its Spectra AI to increase the shipping of deep analytics and superior-resolution imagery to its prospects.

Corporation Presentation

1st Quarter Results:

On May possibly 11th, the organization posted to start with quarter success. BlackSky had a net reduction on a GAAP foundation of 17 cents a share. Revenues rose 90% from the similar time period a year back to just less than $14 million, which nicely beat anticipations. Of this, Imagery and computer software analytical products and services income arrived in at $9.8 million. This was mainly pushed by amplified desire from new and existing authorities contracts. This phase now signifies close to 70% of overall revenues and was up 63% from the exact same period of time a year in the past. Gross margin did drop to 21.2% from 24.5% in 1Q2021. Management attributed this primarily to ‘larger engineering and programs integration bills largely attributable to non-recurring design prices and substance procurement costs’.

Management taken care of whole yr income direction of between $58 million to $62 million. That would stand for 76% revenue progress from FY2021 at the midpoint of that array. Cap-Ex is envisioned to be involving $52 million to $56 million, down from previous calendar year as management thinks it has adequate capacity to satisfy purchaser desire. On June 15th, management reaffirmed direction and also announced a new CFO.

In late May, the Nationwide Reconnaissance Office environment introduced its largest-ever commercial imagery contract energy worth billions of bucks in excess of time. BlackSky was a person of three companies selected alongside with Earth Labs (PL) and Maxar Technologies (MAXR). The over-all contract turned productive as of late Might of this year with a five-calendar year base and various one particular-yr choices with additional progress by 2032.

Analyst Commentary & Equilibrium Sheet:

On Could 12, Benchmark reduced its value target on BKSY to $6 from $8 earlier when sustaining its Buy score on the inventory. That is the only analyst organization commentary I can discover on BlackSky so significantly in 2022. Just below 10% of the fantastic float on this equity is presently marketed brief. Immediately after posting a web reduction of $20 million during the quarter, the organization experienced just in excess of $138 million in funds and marketable securities as of March 31st of this 12 months, towards just around $70 million of extensive-time period credit card debt. An insider acquired $32,000 truly worth of inventory in late February. That is the only insider activity in the stock so considerably in 2022.

Verdict:

The a single analyst organization that has supplied projections all over BlackSky has the corporation dropping 81 cents a share this yr as revenues nearly double to $67.5 million in FY2022. Internet decline is projected to drop to 47 cents a share in FY2023 with revenues climbing just about 90% to $127 million.

BlackSky is in an appealing and expanding area of interest of the current market. The current conflict in Ukraine has underscored the essential significance of real-time Earth intelligence for armed forces, commercial, humanitarian and other apps. The market place has crushed almost all profitless modest-cap advancement names in modern months, irrespective of their advancement prospective clients. This remains a headwind.

This inventory looks reasonably priced primarily based on rate to future product sales, especially when the internet cash on the balance sheet is taken into consideration. I not too long ago profiled Earth Labs and took a ‘check out product‘ holding in that identical worry. I plan to do the exact with BlackSky Technology. We will plan to revisit BlackSky yet again in 2023 as gross sales proceed to achieve traction, and hopefully as internet losses drop significantly.

“It is a way to consider people’s wealth from them with no owning to overtly elevate taxes. Inflation is the most common tax of all.” – Thomas Sowell

[ad_2]

Source backlink

More Stories

Education Technology Integration – Computer Microscopes Are Enhancing the Science Classroom

History: Computers Components and Technology

Considerations for Selling Used Computers