[ad_1]

Nasdaq and Tech Down

Year-to-date, the Nasdaq is down more than 27%, spending most of 2022 in bear territory. But there is hope for certain stocks in the tech sector and investors willing to discover companies with strong fundamentals and interesting opportunities. While we may be headed for an economic slowdown which poses some problems for many tech stocks whose profits have already seen declines and may carve further into their operating losses, some tech stocks have strong prospects, are trading at discounts, and are within industries that are in high demand. Consider our top tech stocks in the semiconductor arena which are used in more and more products.

Top Tech Stocks

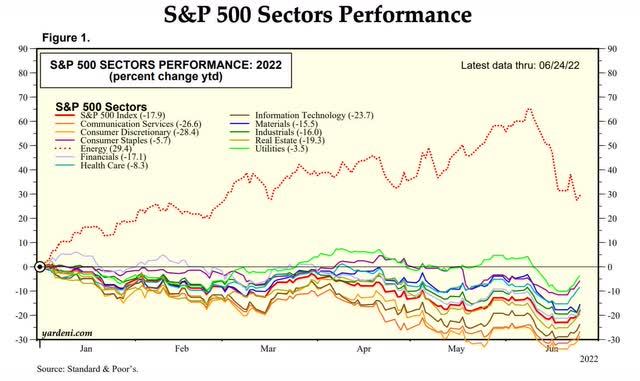

Although fear sentiment has prompted many investors to dump their shares of tech stocks this year, especially in April and May, some investors are finding that the risk-reward of buying the dips could see a bounce-back. Over this year, the tech sector has lost more than $1 trillion in value, with many tech companies experiencing deep losses. The sector as a whole is down 23.7% YTD.

S&P 500 Sector Performance (Yardeni/Standard & Poor)

Despite these losses, the sector is still seeing asset inflows. We believe there is an upside opportunity for a number of beaten-down tech stocks, including these three strong buy recommendations.

1. Daqo New Energy Corp.

-

Market Capitalization: $5.01B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/27): 1 out of 628

-

Quant Industry Ranking (as of 6/27): 1 out of 31

I wrote about Daqo New Energy Corp. (NYSE:DQ) a strong semiconductor equipment stock in an article titled 3 Tech Stocks For a Terrible Market. Since the article’s May 12th publication, DQ has been on a bullish trend, up more than 86%. With its subsidiaries, Daqo is a leading manufacturer and seller of low-cost, high-purity solar power solutions worldwide. Headquartered in China, DQ’s polysilicon material is the main conducting component required by solar products. As the number of solar products grows, Daqo should continue to be a leading clean energy company with high record sales, revenue, and earnings.

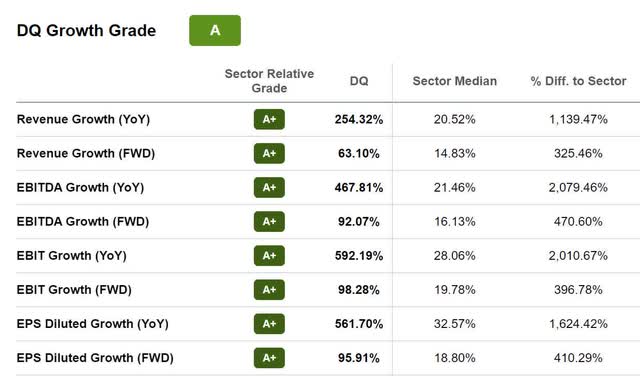

DQ Growth & Profitability

As evidenced by the stellar growth grades, DQ is one of the most profitable companies in its industry and very strong operationally. Currently, the company is experiencing Revenue Growth of 254.32% year-over-year and is experiencing an increase in gross margins.

DQ Growth Grade (Seeking Alpha Premium)

Within the last 90 days, seven analysts have revised their estimates up for DQ, despite a Q1 EPS of $6.99 missing by $0.08, and you can see in the above growth metrics, that the company is doing well. During the Q1 2022 Earnings Call, Daqo CEO Longgen Zhang said,

“We recorded $1.3 billion in revenue, also more than 3x of the revenue for the fourth quarter of 2021, and we recorded operating income of $797 million, net income attributable to Daqo New Energy shareholders of $536 million, earnings per share of $7.17 per share and EBITDA of $827 million, all representing substantial sequential and year-over-year growth.”

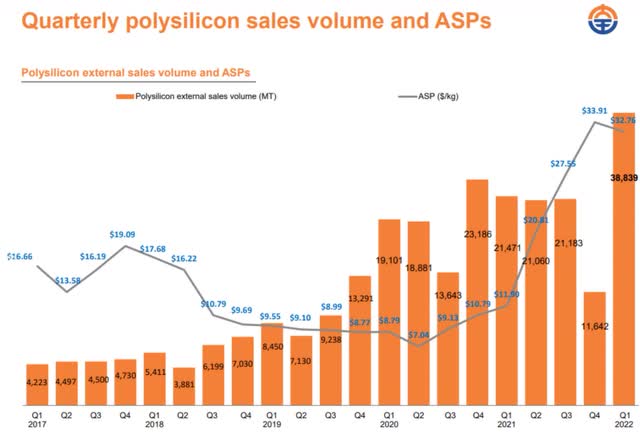

Although the company is experiencing increasing costs like most industries around the globe, its polysilicon powder prices are beginning to normalize to Q3 2021 highs of 74%. Regardless, this high purity material is essential in the production of solar photovoltaic (PV) technology, aka the conversion of light into electricity, and Daqo is experiencing significant sales volumes as a result, substantiating the high demand.

DQ Polysilicon Sales Volumes (DQ Investor Presentation)

As a result of increasing demand, Daqo has ramped up production and acquired a new production facility. DQ possesses strong free cash flow and cash from operations.

“Last year, Daqo set up a roadmap to increase production capacity to 270,000 metric tons MT by the end of 2024, representing a 50% annual growth rate. In Q1, the new Phase 4B production facility was completed. The new facility increased total polysilicon capacity by 35,000 MT. Slight increases in production volume are visible each quarter, which are caused by the ramp-up phase in the latest facility” -Friso Alenus, Seeking Alpha Contributor.

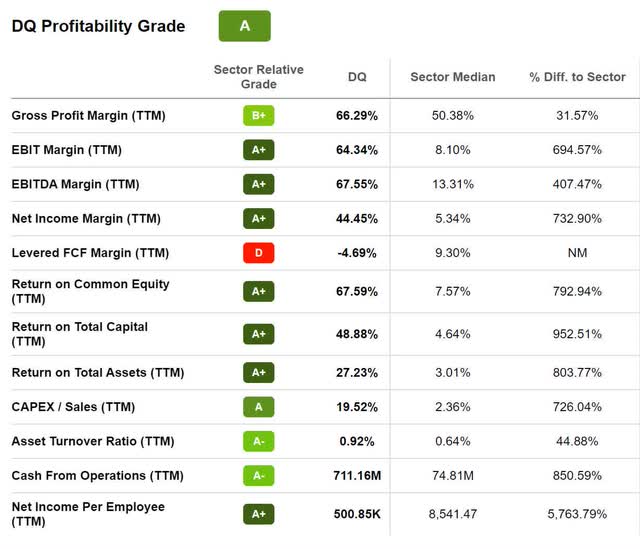

Daqo believes that the polysilicon sector is one of the most profitable in the solar chain and has solid gross profits of 66.29% (TTM), as evidenced below. Gross margins from Q4 2021 to Q1 of 2022 saw a 290-basis point increase mainly attributed to decreased production costs for silicon raw materials.

DQ Profitability Grade (Seeking Alpha Premium)

Despite geopolitical concerns that involved the lockdowns and war abroad posing some headwinds, the overall outlook for DQ remains strong, and the stock comes at a tremendous discount and stellar momentum.

DQ Valuation & Momentum

Year-to-date, DQ is +71%, and over the last year, +9%. Possessing tremendous collective characteristics across all factor grades, it’s no wonder DQ maintains A+ valuation and momentum grades.

With a forward P/E ratio of 3.34x, DQ trades at more than 84% discount and maintains a PEG (TTM) of -98.44% difference to the sector.

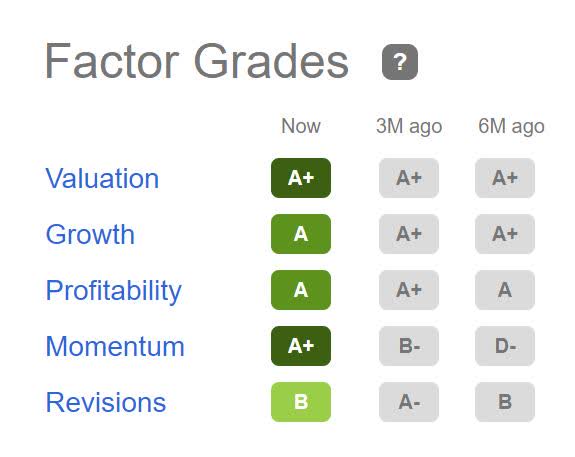

DQ Factor Grades (Seeking Alpha Premium)

On a quarterly basis, this stock is outperforming its peers significantly. While there are some risks associated with this company, including questions about forced labor, that remains to be substantiated. Aside from lockdown concerns and the war in Ukraine affecting supply chain issues, DQ’s cash position has continued to thrive. There are also a number of other Top Semiconductor Equipment stocks that possess Quant Strong Buys. As for Daqo New Energy, the firm has strong liquidity and we see it as a strong buy based on our quant ratings, the data outlined above, along with our next pick, PLAB.

2. Photronics, Inc.

-

Market Capitalization: $1.25B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/27): 3 out of 628

-

Quant Industry Ranking (as of 6/27): 2 out of 31

Semiconductors have increasingly grown in popularity and are in numerous products. As a fan of semiconductors because they have been a resilient force in the tech sector and throughout the pandemic and post-pandemic, and have continued to be in high demand, thus, able to withstand the drawdowns experienced by popular tech stocks. As a semiconductor equipment company, Photronics, Inc. (NASDAQ:PLAB), along with its subsidiaries manufactures and sells photomasks globally. Photomasks are the opaque plates used in the production of integrated circuits or “chips,” making PLAB an excellent stock for consideration in a recession-resilient industry.

Like other tech companies, PLAB has experienced some supply chain disruptions but has managed to maintain strong momentum and trade at a discounted price despite its bullish trend.

PLAB Valuation & Momentum

Tech stocks that provide services for or are involved with semiconductors can offer better upside potential than some of their more risky speculative technology and are trading at more significant discounts. Up 11% YTD and +58% over the last year, PLAB is undervalued.

PLAB Valuation Grade (Seeking Alpha Premium)

In looking at the above valuation grades, PLAB’s forward P/E of 10.71x comes at a near 50% discount to the sector, and the current PEG of 0.09x is a -80.86% difference to the sector.

PLAB Momentum Grade (Seeking Alpha Premium)

Outperforming its sector peers on a quarterly basis, with nine-month and one-year price performances nearly double that of its sector, it’s no wonder PLAB possesses an A+ momentum grade, rising earnings outlooks, and tailwinds. Tech stocks that possess favorable outlooks are increasing production, and as I wrote in 3 FAANG-less Tech Stocks For the Long Haul,

“The start of 2022 has taken mega technology stocks from boom to bust. The economic effects and fears of geopolitical concerns, inflation, and Fed tightening have prompted many investors to consider alternative investments. With record demand for electronic devices, vehicles, emphasis on renewable energy, amid supply chain disruptions, the semiconductor industry is having a heyday, and we have the stock picks that are set to reap the rewards.”

We believe that PLAB is such a stock and its growth and profitability showcase a positive outlook.

PLAB Growth & Profitability

Following tremendous Q2 2022 earnings results with both top and bottom-line beats, the company continues to build partnerships with its network and is leveraging long-term purchase agreements that should aid in de-risking a potential slowdown or headwinds to revenue streams. During the Q2 Earnings call, Frank Lee, Photronics CEO said,

“We once again delivered record revenue in the second quarter, improving 8% sequentially. Our strong end-market demand, the further price realization across the IC segment, and also the continuous production ramping up of our Xiamen and Hefei operations. In addition to the top-line growth, we expand our gross and operating margins. Gross margin was 36% and operation margin 25%. The end result was EPS of $0.49. Cash generation was also strong as we ended the year with $247 million in net cash, which positions us to continue investing in profitable growth opportunities. As CEO, I fully commit to continue our organic growth strategy, the revenue growth, and the margin expansion, and also we’ll keep exploring additional growth initiatives.”

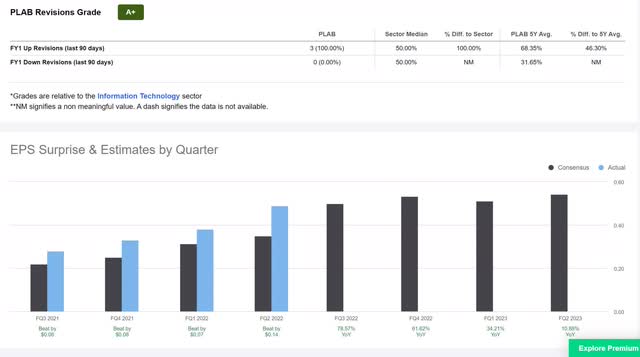

PLAB EPS & Revisions (Seeking Alpha Premium)

The stellar earnings resulted in A+ earnings revisions with three analyst FY1 Up revisions and zero down revisions. Not only has the company increased its forward guidance, but they are also cash-rich with multiple long-term supply contracts. The company is on a bullish trend, as showcased in the last four quarters’ earnings. As Michael Fitzsimmons writes in Photronics Stock: Extreme Value In The Semiconductor Sector,

“The quarter was driven by strong demand, increased price realization across the IC segment, and continued ramp-up of PLAB’s new production facilities in Xiamen and Hefei. Photronics ended the quarter with $329.3 million in cash and long-term debt of only $89.4 million. That equates to a net-cash balance of an estimated $3.93/share based on 61.1 million average fully diluted shares at quarter’s end.”

With a solid network and what appears to be a long runway ahead, PLAB is not only a strong buy recommendation according to quant ratings, it’s also one of my top tech stocks with upside potential.

3. Avnet, Inc.

-

Market Capitalization: $4.17B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 6/27): 4 out of 628

-

Quant Industry Ranking (as of 6/27): 1 out of 9

Distributing electronic components, Avnet Inc. (NASDAQ:AVT) is also in the business of semiconductors, marketing, selling, and as a value-add distributor. With an emphasis on the supply chain, AVT plays a big role in service and design in the electronics ecosystem. Not only does the company position itself between the original equipment manufacturers (OEM) and supplies that develop equipment, Avnet actively uses its tools to analyze and aggregate orders. Fellow Seeking Alpha Contributor Chetan Woodun best describes how Avnet and its competitor Arrow, capitalize on their knowledge of the supply chain.

“In addition to their logistics role, these companies are also involved in product design whereby they support companies in redesigning circuit boards with their teams of field application engineers (FAEs) using advanced design tools for the purpose. In this way, by participating in the manufacturers’ design process, Arrow and Avnet are able to create demand for specific chips manufactured by selected suppliers, while at the same time ensuring their timely supply. For their effort, the two companies are rewarded by the suppliers whose components get the go-ahead for the manufacturing part.”

Given the supply chain headwinds facing companies globally, Avnet is clearly ahead of the game. The stock jumped last week on news of its partnering with Amazon Web Services (AMZN) to help speed up its time to market, scale, and utilize the platform’s other solutions, which should bode well for the company’s already stellar momentum, growth, and profitability.

AVT Growth & Profitability

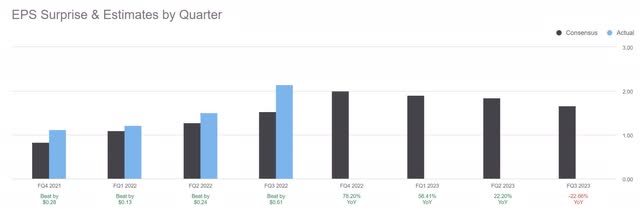

Avnet presented excellent Q3 2022 earnings, with an EPS of $2.15 beating by $0.61 and revenue of $6.49B beating by $779.68M, a year-over-year jump of 31.96%. This resulted in nine FY1 Up analyst revisions and zero down. As showcased in the below chart, AVT has had consecutive earnings beats and is forecasted to continue that trend.

AVT EPS (Seeking Alpha Premium)

“Overall, we continue to forecast favorable demand conditions to hold throughout the second half of this calendar year…Robust demand was again widespread across our end markets. We continue to see strength in the Automotive, Transportation, and Industrial segments. And we expect the Aerospace and Defense segments to remain elevated over the coming quarters,” – Phil Gallagher, Avnet CEO.

While the growth and profitability figures are strong, the company’s momentum and valuation figures are also very attractive.

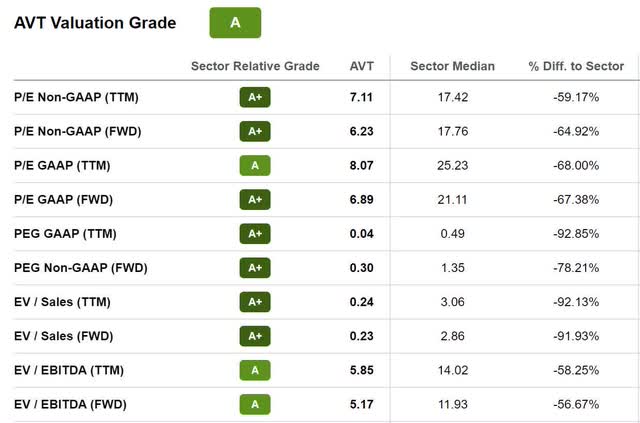

AVT Valuation & Momentum

Avnet comes at an extreme discount, as evidenced by the below data. With a forward P/E ratio of 6.89x, a -67.38% difference to the sector, and A+ PEG (TTM) of 0.04x, a -92.85% difference, AVT is extremely undervalued.

AVT Valuation Grade (Seeking Alpha Premium)

With a share price up +6% YTD and over one year +8%, we’re hoping the stock will capitalize on its partnership with Amazon and tailwinds in its high-demand industry. Unlike my other Semiconductor Equipment recommendations, AVT is branded as a Technology Distributor. It is ranked number one in the industry, but we do have other Top Technology Distributors with Strong Buy recommendations. With this in mind, AVT possesses bullish momentum that is outperforming its peers’ price performance on a quarterly basis. Avnet is a strong buy recommendation according to our quant ratings, and as all of our picks are within the semiconductor industry, should see continued demand for chips globally.

Concluding

A number of tech stocks are great buys due to the technology downfall this year, especially those in the semiconductor space. If you can identify those with fair valuations, solid growth, good profitability, and excellent fundamentals, you may catch these stocks before investors return to the sector en masse.

In the current environment where our three stock picks DQ, PLAB, and AVT experienced stock price declines in April and May as the Nasdaq and mega-tech stocks like Apple (AAPL), Microsoft (MSFT), and Tesla (TSLA) dropped, their current momentum is now strong. Each stock has a future EPS growth rate above 50% and a forward P/E below 10x. As a result, based on their valuations and upside potential, our three picks offer a good balance of growth and value, with continued tailwinds from high demand in their respective industries.

We have dozens more Top Technology Stocks for you to choose from that possess great outlooks and collective characteristics. Finding knowledgeable investment resources is a great way to be a successful investor in volatile markets. Consider using Seeking Alpha’s ‘Ratings Screener’ tool to help you find stocks that achieve diversification into desired sectors you like.

[ad_2]

Source link

More Stories

Apollo Air 2022 Review: Reliable but Quirky

‘Gold Hydrogen’ Is an Untapped Resource in Depleted Oil Wells

An All-Inclusive Guide for Prospective Gold Investors in Brisbane